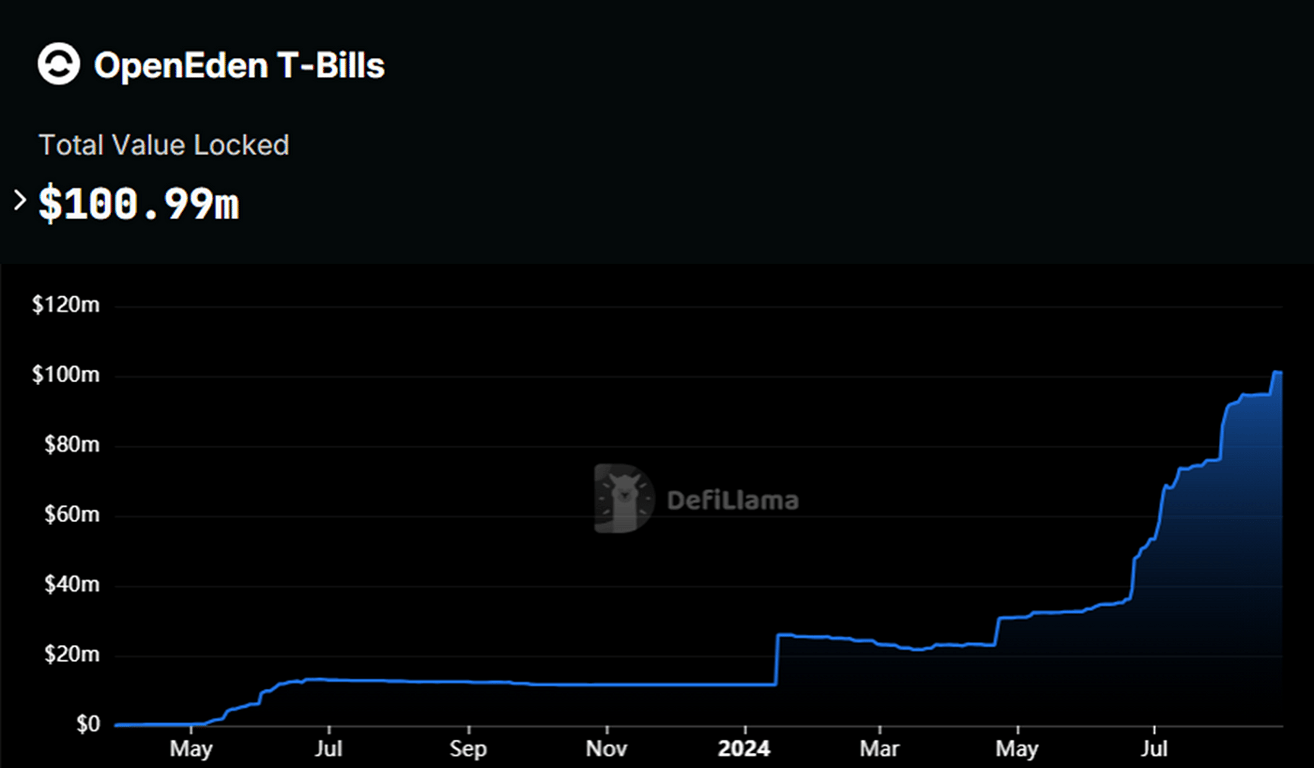

We are pleased to announce that OpenEden has achieved yet another milestone, with over $100 million in Total Value Locked (“TVL”) for our tokenized US Treasury Bills.

OpenEden is now the largest tokenizer of T-Bills in Asia & Europe. Only just last month, we announced crossing $75 million in TVL.

Source: OpenEden’s TBILL TVL, DeFiLllama, dated 26 Aug 2024)

Earning the confidence of crypto treasury managers with our tokenized US Treasury Bills

Much of this growth has come from actively listening to and understanding the needs of DAO treasury managers, crypto funds, and Web3 CFOs.

Short-dated US Treasury securities are one of the most common “cash management” instruments in traditional finance.

But up until recently, there were no institutional-grade on-chain products for crypto treasury managers to earn a “risk-free” yield on their short-term working capital.

We’ve gone to great lengths to address this gap and earn the confidence of crypto treasury managers through:

- Securing an “A” rating from Moody’s

- Completing an independent audit of our governance, controls, and enterprise-wide risk assessment processes from a “Big Four” audit firm

- Operating a licensed investment manager in Singapore

- Managing a bankruptcy-remote regulated mutual fund that backs our TBILL tokens

- ensuring smooth and quick mint/redeem operations

These efforts are bearing fruit.

We previously announced several notable wins, including an allocation from the Arbitrum DAO treasury, and Ripple’s decision to allocate $10m to OpenEden’s TBILL tokens on the XRP Ledger.

Our team continues to engage with more crypto treasury teams to deliver a best-in-class, on-chain “cash management” product.

We are still early

According to RWA.xyz, the total value of tokenized US Treasury securities is already estimated to be at $1.91 billion at present.

We believe this is far below the addressable market for the asset class.

Global demand for US dollars and dollar-denominated assets like US Treasury securities remains enormous. Tokenization holds the potential to expand access and distribution of these assets.

Even as far back as 2016, the Eurodollar market size was estimated at around $13.8 trillion. As of December 2023, there were $26.2 trillion of US Treasury securities outstanding, of which foreign holdings accounted for approximately $8.1 trillion, roughly 30%.

So even if we hit $8 billion in TVL by the end of this year — double the best-case scenario — we will have only touched a mere 0.1% of the total addressable market!

We are still early. And the numbers show it.

Build With OpenEden

In an industry that is often impatient for the next shiny new narrative that comes along, OpenEden remains focused on our mission.

There is a tremendous opportunity that lies in tokenizing more real-world assets and bringing those novel sources of yield into DeFi ecosystems.

If you are keen to build vaults, tokenize structured products like tokenized US Treasury Bills, or want to sandbox ways to integrate our TBILL tokens into your DeFi platform, reach out to us on our social media channels!

About OpenEden

OpenEden operates a leading real-world asset (RWA) tokenization platform, renowned for its unmatched focus on regulatory standards and advanced financial technology. Founded in 2022, OpenEden bridges traditional and decentralized finance by providing, through its regulated entities in Bermuda and the BVI, secure, transparent, and compliant on-chain access to tokenized RWA. OpenEden is tokenizing global finance with a core focus on compliance and innovation. To learn more, visit www.openeden.com.

NOTE: The content is not for publication or distribution, directly or indirectly, in or into the United States of America (including its territories and possessions, any state of the US and the District of Columbia), nor in such jurisdictions where such announcement would require registration and/or approval with any relevant governmental or regulatory authorities (“restricted jurisdictions”). The content is not an offer of financial products or digital assets for sale in the US or such other restricted jurisdictions. The digital assets referred to herein have not been and will not be registered with any regulatory authority or framework, including under the US Securities Act of 1933, as amended and may not be offered or sold in the US or such other restricted jurisdictions, except pursuant to an applicable exemption from registration. No public offering of the digital assets is being made in the US or restricted jurisdictions. For full details on the applicable T&Cs, please refer to https://docs.openeden.com/